social security tax definition

Government on both the employee and the employer. Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on your income level.

Self Employment Tax Everything You Need To Know Smartasset

The hospital insurance part is financed by the Medicare tax.

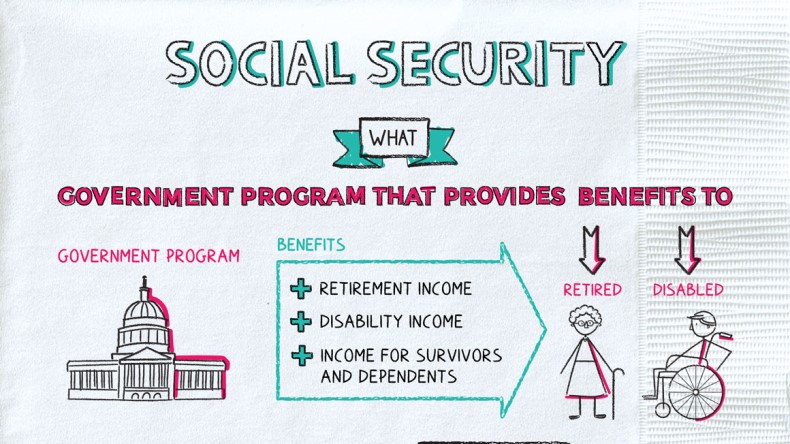

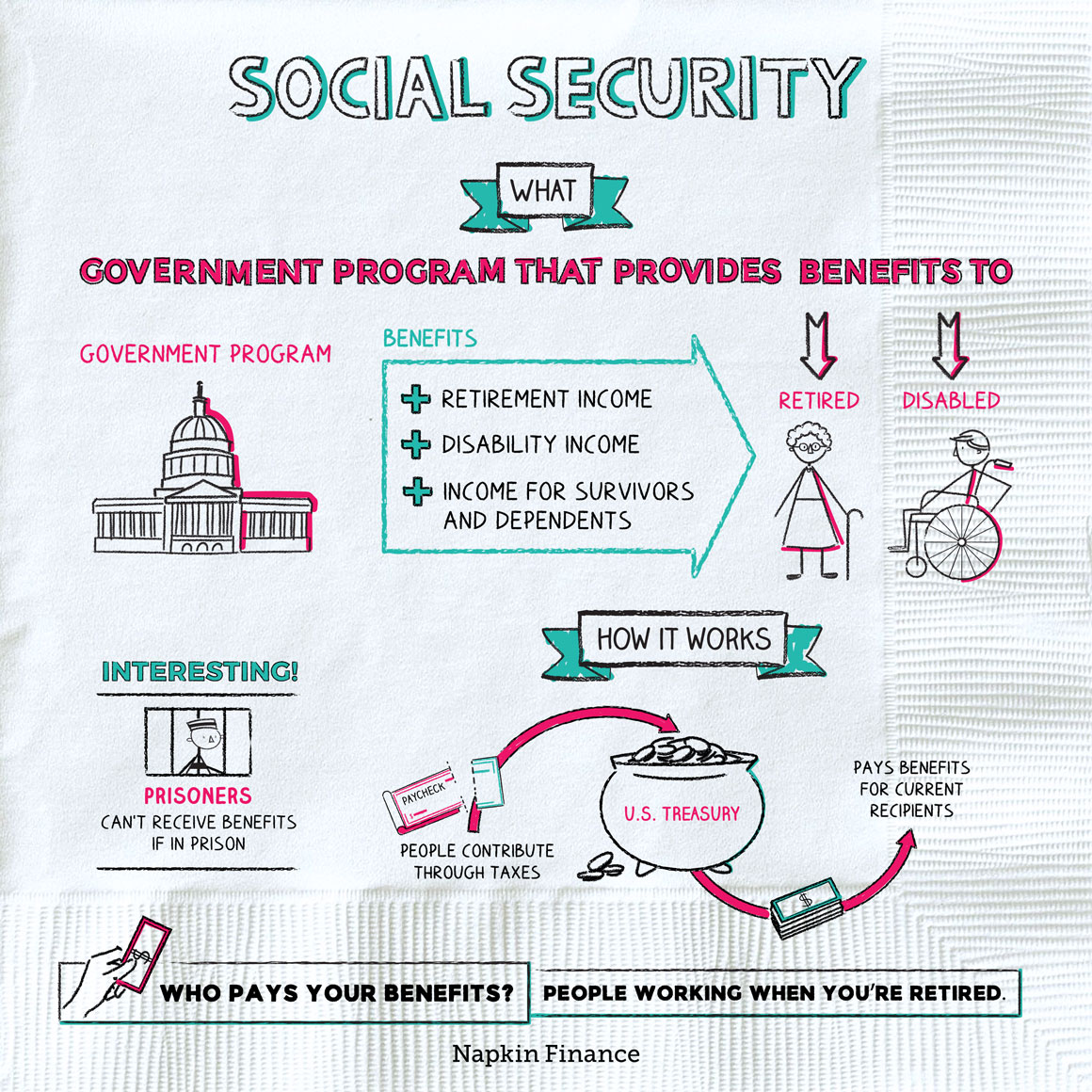

. Social Security was intended to provide financial security to retired seniors disabled persons and surviving spouses of those who at one time worked and paid Social Security taxes. Of your gross wages. Half this tax is paid by.

In 2022 the Social Security tax limit is 147000 up. First recapture taxes penalties and other taxes related to retirement plans to the underpayment of estimated tax to uncollected employee social security tax on tips and on group-term life. An estimated 171 million workers are covered.

Overpayment of Social Security or Supplemental Security Income SSI benefits Excess earnings Voluntary income tax withholding Payment of your appointed representative. Often Social Security Abbr. Between 25000 and 34000 you may have to pay income tax on.

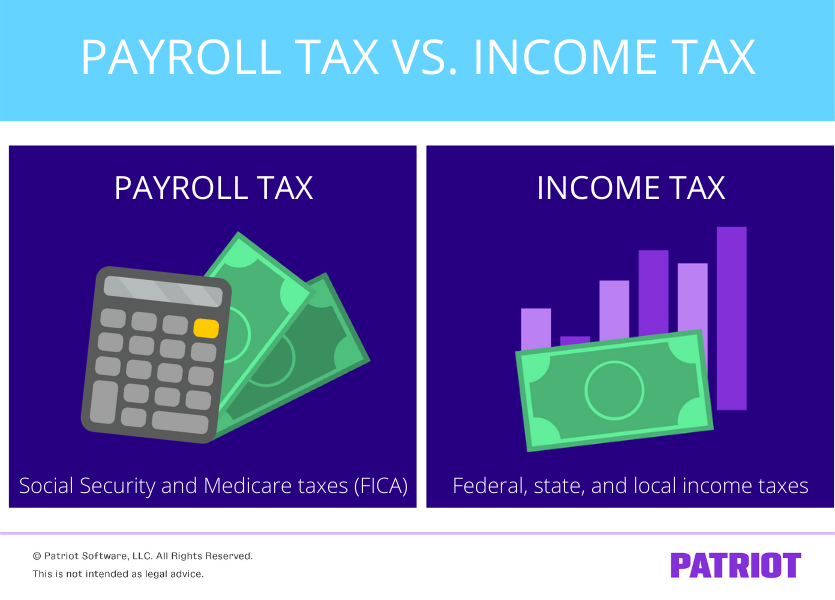

In 2022 the Social Security portion of FICA excluding Medicare to be withheld from the first. Social Security tax 145. Social Security Tax synonyms Social Security Tax pronunciation Social Security Tax translation English dictionary definition of Social Security Tax.

Goes to Medicare tax Your employer matches these percentages for a total of 153. Social Security Tax FICA Definition. Social Security and Medicare Withholding Rates.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Social-security-tax as a means A tax that pays for retirement benefits disability benefits and survivors benefits that are paid to retired workers. SS A government program that provides economic assistance to persons faced with unemployment disability or agedness financed by.

Fifty percent of a taxpayers benefits may be taxable if they are. Social Security tax is also used to fund survivorship benefits that is to say benefits paid to a surviving spouse of a qualifying retiree or a dependent child whose parent has died. The current rate for.

The Social Security tax is levied by the US. Often Social Security Abbr. As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800.

Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

The old-age survivors and disability insurance part is financed by the Social Security tax.

What Are Employer Taxes And Employee Taxes Gusto

What Is The 16 728 Social Security Bonus Secret

What Are Social Security Benefits Social Security Faq What S Social Security

Taxation Of Social Security Benefits Mn House Research

How Are Payroll Taxes Different From Personal Income Taxes

What The Form W 2 Box 12 Codes Mean H R Block

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

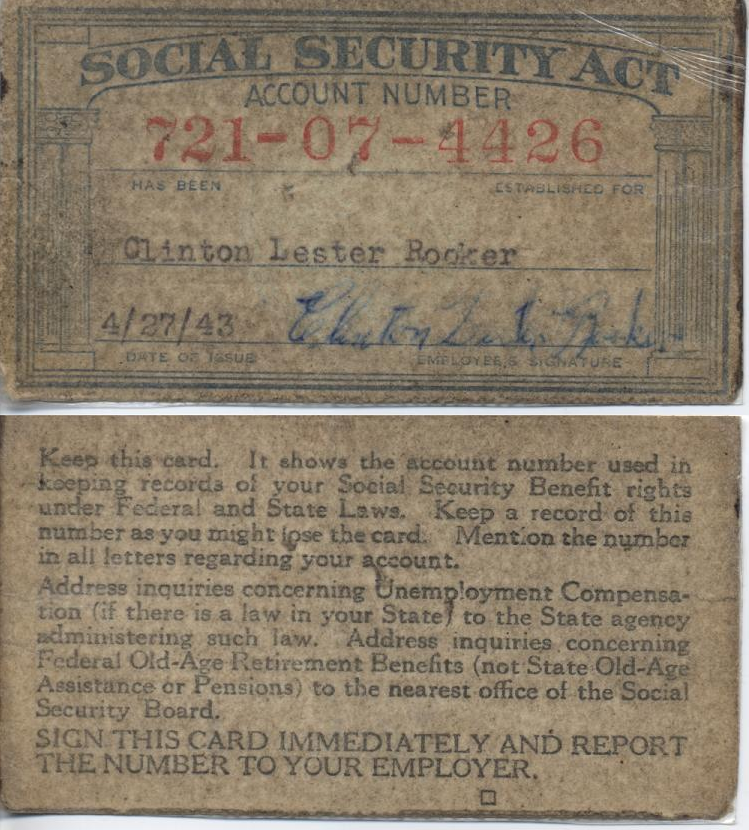

History Of Social Security In The United States Wikipedia

Social Security United States Wikipedia

What Is A W 2 Form Turbotax Tax Tips Videos

Taxes Payroll Taxes Especially Social Security Are Regressive Not The Homa Files

What Are Social Security Benefits Social Security Faq What S Social Security

Social Security Update Archive Ssa

2019 Payroll Taxes Will Hit Higher Incomes

Policy Basics Understanding The Social Security Trust Funds Center On Budget And Policy Priorities

Social Security Number Wikipedia

Problem 3 Incorrect Definition Of Compensation Nova 401 K Associates

New Mexico Social Security Tax Exemption On Deck For Committee Hearing